Inspiring Action- An Art or a Science?

I’ll jump right on that!! Five simple words that can either convey the attitude of a person eager and motivated to get something done, or a sarcastic way of declining a request based on it being either an uninspiring or unrewarding experience (or perhaps both).

Much of what we know about performance management comes from the behavioral sciences and the work of legendary psychologist B. F. Skinner. In case you missed that day in your Psych 101 class, basic behaviorism is built on the simple concept of providing a tangible reward–a piece of food in the case of experimental animals–in response to the correct achievement of some basic task (or, conversely, the withholding of a reward–or administration of a penalty of some sort–for failure to complete the task).

Pigeons, Teenagers, and Everything In Between

Pigeons, Teenagers, and Everything In Between

When we talk about the field of performance management–be it measurement, goals and targets, tracking and reporting, performance communications, back-end rewards, or the myriad of other “moving parts” within the performance management process–we are really talking about elements that are at the core of managing human behavior.

While most of us regard performance management techniques as a way to motivate our organizations and employees to achieve “peak performance” levels, the same techniques can be used in an infinite number of other areas, across both the work and personal spectrum. Remember, while Skinner’s subjects were originally pigeons, his techniques have been applied effectively in everything from corporate performance to the most basic of personal transactions with our children… and everything in-between.

…and Yes, Customers Too!

Recently, I’ve been giving a good deal of thought to how we can use these same principles in our relationships with customers. There are many things we do to encourage customers to behave in certain ways. Whether it’s buying more of a product, maintaining allegiance to our brand, or other more subtle changes we seek in customer behavior (shifting to less costly billing and payment channels, moving consumption to more optimal places in our delivery system, increasing utilization of our automated inquiry channels (website, IVR, etc.), participating in recycling campaigns, etc.), the age old “behavior modification” techniques used by the early behaviorists, still present in most of our performance management organizations, are just as, if not more, important to our relationships and interactions with customers. It’s all about creating a line of sight between a desired outcome and the behaviors required to drive it, keeping that line of sight visible, and ensuring that all requisite parts of the process are in place to motivate and reinforce staying on that path and consistently hitting the desired target.

A few days ago, a close friend of mine who enjoys spending an occasional weekend in Las Vegas (something I know very little about, or at least wouldn’t admit to if I did!), received, during one of these periodic jaunts, a loyalty card from a casino offering him certain amenities whenever he visited their property–usually free (or at least that’s the spin they put on it) dinners, valet parking, etc. Personally, I find it hard to see these loyalty programs as being of any great value, since I’m sure the rewards pale in comparison to how much casinos “fleece” their patrons. But regardless of how I view that industry and their programs, my friend seems to enjoy them. And, well, who am I to judge?

After visiting the casino a few times in 2011, he received a letter letting him know that he had reached a new loyalty level (again, one has to wonder about achieving a new loyalty level at a casino whose primary mission it is to take your money. But let’s not digress again). After quickly congratulating him on achieving this “new loyalty tier”, the program manager went on to describe how close my friend was to reaching the next level beyond his newly attained one.

I may not have all of my numbers exactly right, but it went something like this: “Congratulations on achieving our Silver level by earning 15,000 points! You’re now only a few steps away from hitting the Gold level. By earning an additional 900,000 points, you’ll enjoy all the benefits of Silver PLUS all the many new benefits reserved exclusively for our Gold members!” etc, etc, etc…

Sometimes there is not enough oxygen on the planet to describe how many things are wrong with a particular business practice. This was one of those times. But the letter alone did most of the damage. Whatever the expenditures required to get to the “silver level” (and I really didn’t want to know the details), simple math told him that he’d need to spend many, many, many multiples of that to even approximate the next level. After a good laugh, his response was: “Sure, I’ll get right on that!”

Motivating Loyalty-

The good, the bad and the ugly…

Loyalty programs all include features of this sort: tiers of benefits that reward buying behavior, incentives for climbing to the next tier, quantifiable measures and tracking schemes that let you know how you are doing on your progress, and all the communication required to motivate you up and over the “next hurdle.” It doesn’t matter whether the program is for frequent fliers, hotel visitors, or even banking savers (an alternative I would encourage my friend to consider). There is no doubt that such programs work.

What differentiates the good ones is not simply the presence of elements like measures, goals, and rewards but, rather, the range of “moving parts” within the PM process I alluded to earlier. For example, let’s look inside my friend’s experience. It wasn’t the lack of a measurable outcome or awareness of what he had to do to get to the next tier that created the breakdown, but rather the enormous gap between the tiers (where the target was set), its level of achievability, and the manner in which progress was communicated.

Sometimes the issue is as simple as managing distinctions between tiers and levels. For a person like me who travels extensively, upgrades, for example, are certainly important. But as airlines continue to consolidate, customers who might have grown used to being consistently upgraded now find that while they were once big fish in a small pond, they have now become average-sized fish in a much larger lake. Anyone caught in the consolidation of the United and Continental loyalty programs knows this first-hand. In fact, there are now more “elite” than “non-elite” fliers (usually by a factor of two) competing for that “special boarding” privilege (essential for getting dibs on very scarce and valuable carry-on luggage space). So for me, the boarding privileges have become more valuable than the upgrade itself. Simply differentiating between platinum, gold, and silver elite fliers in the boarding process would improve the experience of those with the highest travel frequency. Further distinctions (within the higher tier) would also help to create more perceived equity within the ever growing mass of frequent travelers when it comes to upgrades.

More often than not, the differences lie in more subtle application of the “moving parts” within the process. There is a principle most of us may remember from that Psych 101 course that deals with the specifics of reinforcement “schedules” (variable/fixed intervals, for example). While it’s nice to get “upgraded” every single time we exhibit the expected behavior, true behaviorists would tell you that is a clear path to complacency (besides which, the experimenter–or in our case, the program manager–ends up spending a great deal more than necessary in rewards in order to achieve a desired result). Whether they are right or wrong in this assertion is not the issue; market research can answer that. The real issue is that nuances such as this remain very much in play and should not be simply ignored or overlooked in a program’s design. Most of us can recall a time as a customer when receiving an unexpected extra (what we in the south call lagniappe ) did, in fact, generate good will and motivate improved buy behavior. A colleague of mine talks about this quite extensively on his blog “Marketing Lagniappe,” and, although he does not purport to be a true southerner, he understands the concept and its application better than most that actually hail from the “Big Easy”.

Incorporating Performance Management into your CEM strategies…

Like any good chef, there are many ingredients that need to be mixed in the correct sequence, at the right temperature, and presented in the right way to create that high-quality, positive experience. Same goes for designing our customer experiences:

- Are the incentives you’re offering ones customers even care about? How much time and energy are you wasting on deploying innovative tools that have more impact for you that they do for customers?

- Are your incentives easy for customers to redeem? .Small “point of sale” rebates are often have far more “relevant impact” than larger ones that require more customer effort to redeem (after adjusting for lower redemption levels)

- Do you rely on hidden tricks to manage program costs (e.g., points that expire, rewards that require supplemental cash payments, etc.) that can actually produce more negative that positive impact on customer experience?

- Are the measures you’re using easy and simple for customers to understand and use in tracking their progress to that next reward or level?

- Have you considered the effect of different reinforcement schedules? (Fixed versus variable intervals? Different types and quantity of rewards?

- Have you given enough thought to where program “targets” (rewards and tiers) are set?

- Are the targets achievable in reasonable amounts of time?

- Is your messaging and communication sufficiently compelling?

Clearly these techniques apply any time we are trying to convince someone to “jump right on it.” But in the world of customer experience, where competitive forces are always at play and differentiation is becoming more and more critical, it may just be the most important consideration in your product and program design.

-b

Bob Champagne is Managing Partner of onVector Consulting Group, a privately held international management consulting organization specializing in the design and deployment of Performance Management tools, systems, and solutions. Bob has over 25 years of Performance Management experience with primary emphasis on Customer Operations in the global energy and utilities sector. Bob has consulted with hundreds of companies across numerous industries and geographies. Bob can be contacted at bob.champagne@onvectorconsulting.com

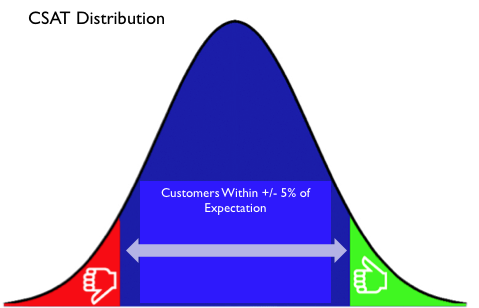

While they were few and far between, there were failures and successes on “the fringes” of the distribution. I’ve shown a simple example of what I mean, although I believe actual research on a broader set of experiences would probably show that the distribution is anything but “normal” /gaussian (i.e. these days it is likely skewed to the left assuming customers still have some semblance of expectation (hope) of good service, which of course, is debatable (I’ll leave that for another post).

While they were few and far between, there were failures and successes on “the fringes” of the distribution. I’ve shown a simple example of what I mean, although I believe actual research on a broader set of experiences would probably show that the distribution is anything but “normal” /gaussian (i.e. these days it is likely skewed to the left assuming customers still have some semblance of expectation (hope) of good service, which of course, is debatable (I’ll leave that for another post).